Quitclaim Deed Las Vegas: Easy Property Transfer Guide

- WebsiteFix Technical Partner

- Jul 29, 2025

- 13 min read

Updated: Aug 12, 2025

A quitclaim deed in Las Vegas is one of the simplest ways to transfer property ownership from one person to another. The key thing to understand is that it comes with no guarantees about the property's title.

Think of it like this: you're handing over a set of keys to someone you trust. You're giving them whatever access you had, but you’re not providing a certified history of every person who ever held those keys before you. That’s the essence of a quitclaim deed—it's an "as-is" transfer.

What Is a Quitclaim Deed and When to Use One in Las Vegas

When you use a quitclaim deed, you're not selling the property in the traditional sense. Instead, you're simply transferring your ownership interest—whatever that may be—to someone else. This makes it a fast and straightforward legal instrument, but one that should be used carefully.

Every quitclaim deed involves two main parties:

The Grantor: This is the person currently on the title who is giving up their ownership stake.

The Grantee: This is the person receiving that ownership stake.

The grantor is, quite literally, "quitting their claim" to the property. They are not promising that the title is perfect or free from other claims (like liens or old mortgages). The grantee receives exactly what the grantor owned, warts and all.

When a Quitclaim Deed Makes Sense

Because there are no warranties, you’ll almost never see a quitclaim deed used in a standard home sale between strangers. That would be far too risky for the buyer. Instead, they are the go-to tool for situations where the parties already know and trust each other.

People in Las Vegas choose quitclaim deeds for their simplicity and speed, especially when dealing with family matters or simple title adjustments. Clark County sees thousands of these filed every year, often to add or remove a name from a title without the complexity of a full sale.

Here are a few of the most common situations where a quitclaim deed is the perfect fit.

Common Scenarios for a Las Vegas Quitclaim Deed

This table outlines some typical use cases you'll find right here in Nevada.

Scenario | Brief Explanation | Why a Quitclaim Deed Fits |

|---|---|---|

Adding a Spouse to a Title | After marriage, one spouse wants to add the other to the deed of their home, making them a co-owner. | It's a simple transfer between trusted partners. No sale is taking place, just a change in ownership status. |

Removing a Spouse After Divorce | As part of a divorce settlement, one spouse is required to transfer their interest in the family home to the other. | The transfer is legally mandated and between parties who are well-acquainted with the property's history. |

Gifting Property to Family | Parents want to gift a vacation home or a piece of land to their adult children. | This is a gift, not a sale. The family relationship provides the necessary trust to forgo title warranties. |

Clearing Up Title "Clouds" | A minor issue, like a misspelled name or an old, unresolved claim from a previous owner, needs to be fixed. | A person with a potential claim can sign a quitclaim deed to officially relinquish any rights, clearing the title. |

These scenarios highlight why quitclaim deeds are so popular for non-sale transfers—they get the job done efficiently when trust is already established.

Key Takeaway: A quitclaim deed is a specialized tool for quickly transferring property interest without any warranty. It shines in transactions between trusted parties, like family members, but is not the right choice for buying a home from a stranger.

The good news is that you no longer have to navigate this process through cumbersome in-person meetings. With modern virtual notary services and online document preparation, you can get the deed drafted correctly and notarized from just about anywhere. It simplifies the entire ordeal. For a more detailed walkthrough, feel free to check out our guide on the quitclaim deed process.

Nevada's Legal Requirements for Your Quitclaim Deed

While a quitclaim deed is a relatively simple tool, it still has to follow specific state rules to be legally binding. Think of it like a boarding pass—if any key information is wrong or missing, you’re not getting on the plane. Fortunately, the requirements for a quitclaim deed in Las Vegas are quite clear, and modern services have made meeting them easier than ever.

The heart of any valid deed is who signs it and how that signature is verified. In Nevada, the law is crystal clear: the person giving up their property interest (the grantor) must sign the deed. If the property is considered community property owned by a married couple, both spouses will typically need to sign to transfer the entire interest.

Important Note: A signature by itself isn’t enough. To be legally valid and accepted for recording, the signatures on a quitclaim deed absolutely must be notarized. This is a non-negotiable step that confirms the identity of the signers and the authenticity of the document.

The Power of Digital Notarization

Not long ago, getting something notarized meant finding a notary, scheduling an appointment, and driving over to sign a physical document in person. That whole process has been completely updated. Today, Remote Online Notarization (RON) lets you handle this crucial legal step from anywhere with an internet connection.

Using a secure video call, a certified Nevada notary can watch you sign, verify your ID, and apply their digital seal to the document. This virtual approach offers incredible convenience and security, cutting out all the logistical headaches of the old way. It perfectly satisfies Nevada's legal requirements without you ever having to leave your home or office. Many professional online document preparation services now build RON right into their process, making everything seamless from start to finish.

Making It Official in Clark County

Once your quitclaim deed is correctly filled out and properly notarized, there's just one final step to make the transfer official: filing it. The document must be recorded with the county recorder's office where the property is located. For any property in Las Vegas, that means filing it with the Clark County Recorder’s Office.

This step is absolutely critical. Recording the deed creates a public record of the ownership change, which is what protects the new owner’s (the grantee's) rights. It officially puts the world on notice that the property has a new owner.

To recap, Nevada statutes require a quitclaim deed to be signed by the grantor (and often their spouse), properly notarized, and then recorded to take full effect. The notarization itself has to follow specific state laws for certification and stamping. For a deeper look at these rules, you can find more information about Nevada’s deed regulations on LegalTemplates.net. The good news is that when you use an online service, they can usually handle the electronic filing for you, ensuring it gets to the right place quickly and correctly.

Quitclaim Deed vs. Warranty Deed: What Is the Difference?

When you're dealing with property deeds, it helps to think in real-world terms. Imagine buying a used car. You could buy it "as-is" from a private seller with no promises about its history, or you could get a certified pre-owned vehicle from a dealership that comes with a full inspection report and a guarantee.

A quitclaim deed in Las Vegas is the "as-is" option. It's fast and straightforward. A warranty deed, on the other hand, is the certified, guaranteed option. The core difference boils down to one crucial element: the warranty of title.

The Critical Role of a Title Warranty

A warranty deed includes a powerful, legally binding promise from the seller (the grantor) to the buyer (the grantee). They are guaranteeing that they own the property free and clear of any hidden claims, liens, or ownership disputes. If an old tax lien or a long-lost heir suddenly pops up with a claim to the property, the grantor who signed the warranty deed is on the hook to fix it. This is why it’s the gold standard for traditional home sales—it gives the buyer invaluable protection.

A quitclaim deed makes no such promises. It simply transfers whatever ownership interest the grantor currently has—if they have any at all. It’s a complete transfer of risk. If it turns out the grantor’s title was flawed or they didn't even own the property, the new owner has no legal comeback against them. This is precisely why quitclaim deeds are almost exclusively used between people who trust each other completely.

Key Insight: The defining feature of a quitclaim deed is its lack of a title warranty. All the risk associated with the property's history is transferred from the grantor to the person receiving it, the grantee.

To make this crystal clear, let's compare the two side-by-side. The following table highlights the essential differences you need to know.

Quitclaim Deed vs. Warranty Deed: A Quick Comparison

Feature | Quitclaim Deed | Warranty Deed |

|---|---|---|

Title Guarantee | None. The grantee receives only the grantor's current interest, whatever that may be. | Full Guarantee. The grantor promises the title is clear and will defend it against all claims. |

Risk Level for Grantee | High. The grantee assumes all risk for any past title defects or hidden claims. | Low. The grantor is legally responsible for resolving any title issues that may arise. |

Typical Use Case | Gifting property to family, divorce settlements, clearing title "clouds." | Traditional property sales between buyers and sellers who are strangers. |

Best For | Transactions built on trust and speed, not financial protection. | Secure transactions where the buyer needs assurance of a clean title. |

After looking at this comparison, the quitclaim deed might seem like a risky move. But in the right context, its speed and simplicity are exactly what’s needed. For situations where financial protection isn't the primary goal, it's an incredibly useful tool. You can dive deeper into these specific situations by exploring the benefits of a quitclaim deed in more detail.

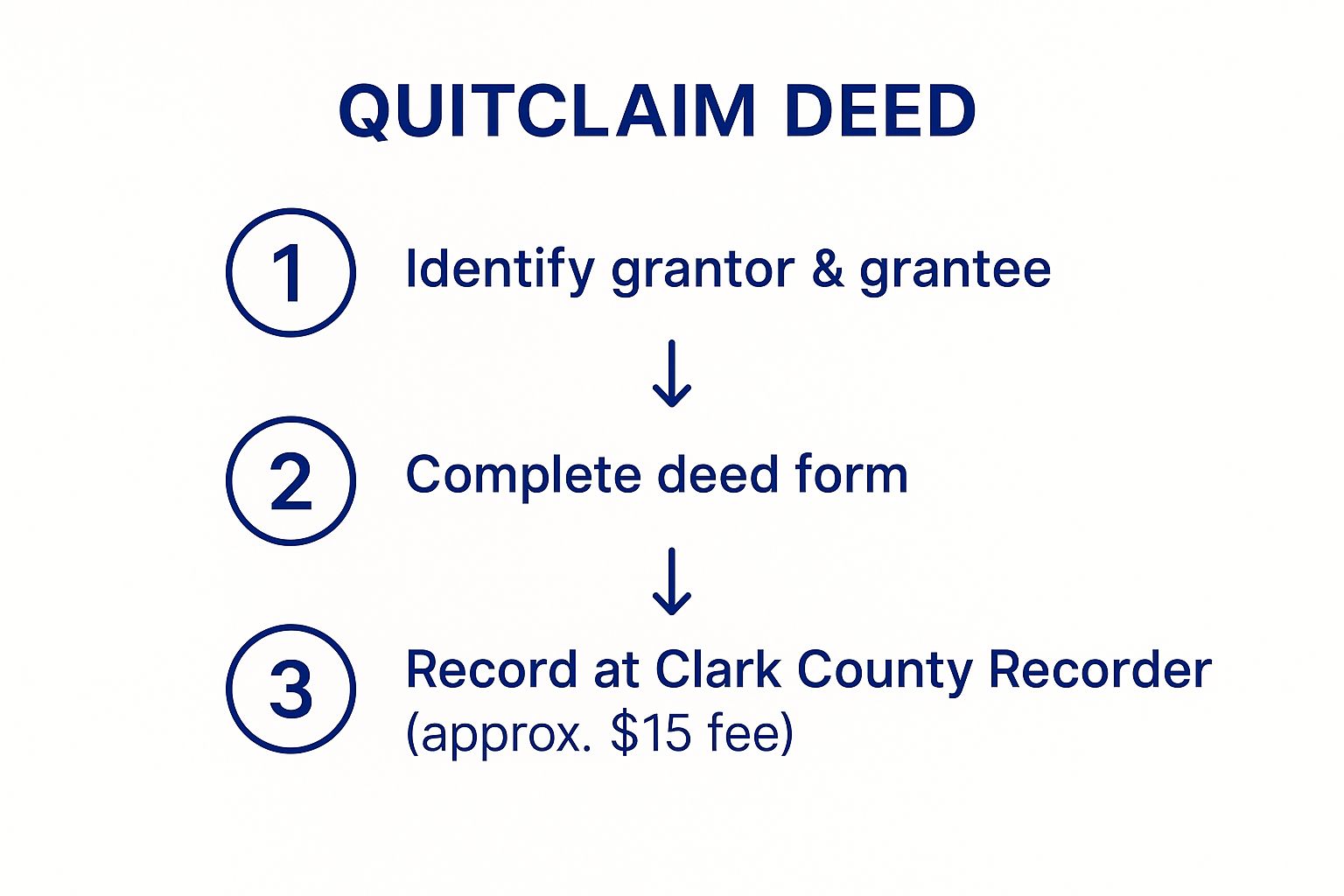

How to File a Quitclaim Deed in Las Vegas Step by Step

Filing a quitclaim deed in Las Vegas might sound complicated, but it’s really just a series of well-defined steps. Think of it as a roadmap. I’ll walk you through each stage required here in Clark County, from getting the right form to making it all official. Along the way, you'll see how modern virtual services can take the friction out of the entire experience.

Step 1: Obtain the Correct Quitclaim Deed Form

First things first, you need the right paperwork. Specifically, you need a quitclaim deed form that meets all of Nevada's legal requirements. You can certainly find generic templates online, but honestly, that’s a gamble. A form that’s outdated or improperly formatted could be flat-out rejected by the Clark County Recorder’s Office, or worse, create a hidden flaw in the property's title that becomes a major headache later.

This is where a professional online document preparation service proves its worth right away. Instead of crossing your fingers with a generic template, you get a fully compliant, correctly formatted deed prepared for you. This simple move ensures you’re starting with the right materials and sidesteps any potential issues from the get-go.

Step 2: Accurately Complete the Deed

Once you have the correct form, it’s time to fill it out. And I mean perfectly. Every single detail has to be spot-on.

Grantor and Grantee Information: You’ll need the full, legal names of the person transferring the property (the Grantor) and the person receiving it (the Grantee). No nicknames or shortcuts here.

Property's Legal Description: This isn't just the street address. You need the complete legal description as it appears on a previous deed—this includes details like the lot, block, and subdivision name.

Assessor’s Parcel Number (APN): This is the unique ID number the Clark County Assessor uses to track the property for tax purposes. It’s absolutely essential.

A single mistake in any of these fields can void the whole transfer. Using a virtual service that specializes in document preparation helps safeguard against these errors, often by cross-referencing public records to confirm the details are precise. For a deeper dive, check out this guide on ensuring document integrity in real estate transactions.

Step 3: Get the Deed Notarized

Here’s a step you cannot skip: under Nevada law, the grantor's signature on the quitclaim deed must be notarized. This official act verifies the identity of the person signing and confirms they are doing so willingly. In the past, this meant finding a notary public, booking an appointment, and traveling to meet them in person.

Today, Remote Online Notarization (RON) has completely changed the game. You can connect with a certified Nevada notary from your own home or office through a secure video conference. It's not just more convenient; it’s a fully legal and binding method that lets you complete this crucial step in minutes, not days.

Key Advantage: Remote Online Notarization eliminates the hassle of travel and scheduling conflicts, making it the most efficient way to satisfy Nevada’s notarization requirement for your quitclaim deed.

Step 4: Complete the Declaration of Value Form

In addition to the deed itself, you'll also need to fill out a Nevada Declaration of Value form. This document discloses the property's value and is used to figure out if any real estate transfer tax is owed. Even if the transfer is a gift between family members (which is often exempt from the tax), you are still required to complete and submit this form.

Step 5: File with the Clark County Recorder

The final leg of the journey is taking your signed, notarized quitclaim deed and the completed Declaration of Value form to the Clark County Recorder’s Office. This is the act of "recording," and it’s what officially makes the property transfer part of the public record. It’s the step that ultimately protects the new owner’s rights to the property.

This image breaks down the core workflow for a Las Vegas quitclaim deed.

Full-service virtual platforms can actually handle this entire five-step process for you. From preparing the documents to arranging the remote notarization and even managing the final county filing, they transform what can be a complex, multi-stage task into a single, straightforward digital process.

How Online Services Simplify Your Property Transfer

Not long ago, handling a quitclaim deed in Las Vegas meant a frustrating cycle of office visits, phone tag, and wrestling with paperwork. Thankfully, technology has completely transformed this outdated process. Today, online and virtual services offer a faster, more secure, and infinitely more convenient way to manage your property transfer from start to finish.

Think of it like the difference between mailing a letter and sending an email. Sure, both can deliver a message, but one is instant, trackable, and can be sent from anywhere. Online platforms for document preparation and notarization bring that exact same efficiency to real estate.

The Convenience of Remote Online Notarization

The biggest game-changer is undoubtedly Remote Online Notarization (RON). Nevada law fully embraces RON, which means you can get your quitclaim deed legally notarized without ever leaving your home. This virtual approach cuts through the biggest logistical headaches of the old way.

Instead of juggling schedules to get all signers and a notary in the same physical room, you simply connect with a certified Nevada notary over a secure video call. The benefits are massive and immediate:

Ultimate Flexibility: You can complete the signing from your office, your living room, or even while on vacation. A decent internet connection and your ID are all you need.

Serious Time Savings: Forget battling traffic to get to a notary's office. A remote session is often done in just 15-20 minutes.

Less Stress: The pressure is off. You don't have to coordinate a group meeting, which is a huge relief in sensitive situations like divorces or family property shifts.

Document Preparation as Your Safety Net

Beyond just the signing, good online services act as your expert guide. Drafting a quitclaim deed demands precision. One tiny mistake—a typo in a legal description or a misspelled name—can create a massive title headache down the road. This is where an online document preparation service becomes your safety net.

These virtual services ensure every last detail on your quitclaim deed is correct and complies with all Clark County and Nevada state laws. They check property details, confirm all required fields are filled out, and produce a clean, recordable document. This professional review prevents simple errors from turning into costly problems that could derail the entire transfer.

Expert Insight: Using a professional service for your quitclaim deed isn't just for convenience—it's for risk management. It makes sure the document you're using to solve one problem doesn't accidentally create a new, more expensive one.

A Centralized, End-to-End Solution

The real magic of using a virtual provider is seeing how all the pieces come together. A top-tier service merges expert document preparation with secure Remote Online Notarization into one smooth, connected workflow.

This means you can:

Get your quitclaim deed in Las Vegas professionally drafted and double-checked for accuracy.

Book and complete the notarization online, at a time that actually works for you.

In many cases, have the service take care of the final step: filing the deed with the Clark County Recorder’s Office.

This unified model turns a disjointed, multi-step chore into a straightforward digital experience. It puts you in control, gives you back your valuable time, and delivers the peace of mind that comes from knowing every legal box has been ticked by a professional.

Common Questions About Las Vegas Quitclaim Deeds

As you get ready to transfer a property, the practical "what-ifs" start popping up. It's completely normal. Let's walk through some of the most common questions we hear about using a quitclaim deed in Las Vegas, giving you the straightforward answers you need to move forward with confidence.

Does a Quitclaim Deed Affect My Mortgage in Las Vegas?

Yes, and this is a big one. Think of it this way: a quitclaim deed transfers ownership of the house, but it does not transfer the mortgage debt attached to it. The person who originally signed the loan papers (the grantor) is still on the hook for the payments, even if they no longer own the property.

There's another catch, too. Most mortgages have a "due-on-sale" clause. This fine print gives the lender the right to demand the entire loan balance be paid immediately if you transfer the property. Before you even think about filing a quitclaim deed on a mortgaged property, you absolutely must talk to your lender first.

Can I Prepare a Quitclaim Deed Myself?

Technically, you can. You can find a template online and fill it out yourself. But honestly, it's a risky move. Nevada real estate law is incredibly specific, and a simple mistake can cause huge problems down the road.

A misspelled name, an incorrect legal description, or a botched notarization can make the whole deed invalid. Even worse, it could create a "cloud on title," a legal mess that’s expensive and time-consuming to clean up later.

A professional online document preparation service isn't just about convenience; it's about managing risk. Getting the deed right from the start saves you from future legal battles and costs that are far greater than the initial prep fee.

What Are the Costs to File a Quitclaim Deed in Clark County?

The total cost isn't just one single fee; it's a combination of a few things. You'll need to account for:

Recording Fee: This is what the Clark County Recorder’s Office charges to make the deed an official public record.

Transfer Tax: Many quitclaim transfers, especially between family, are exempt. However, you still have to file a Declaration of Value form to prove it.

Preparation & Notary Fees: This is the cost for having the document professionally drafted and legally notarized.

Often, the most budget-friendly path is an all-in-one virtual service. By bundling online document prep with remote notarization, you usually spend less than you would hiring a lawyer and a separate notary, and you save yourself the time and gas money of running around town.

How Long Does the Process Take with Online Services?

This is where you really see the difference. The old-fashioned way could easily stretch into weeks, between coordinating schedules with a notary and mailing documents back and forth. Online and remote services change the game completely.

With a virtual service, document preparation is often done within 24-48 hours. The remote online notarization session itself is quick—usually under 20 minutes—and you can schedule it whenever works for you. Once it's notarized, the deed is ready for immediate electronic filing. The whole process shrinks from weeks down to just a few days.

Ready to handle your Las Vegas property transfer with confidence and ease? Let Signature on Demand manage the details for you. Our expert virtual document preparation and convenient Remote Online Notary services ensure your quitclaim deed is accurate, compliant, and completed without the hassle. Visit us at https://signatureondemand.net to get started today.

Comments