Your Guide to the Quitclaim Deed Process

- WebsiteFix Technical Partner

- Jul 1

- 15 min read

When people talk about transferring property, the term "quitclaim deed" often comes up, but it's frequently misunderstood. Put simply, a quitclaim deed is a legal instrument used to transfer ownership interest in a property from one person (the grantor) to another (the grantee). It's a quick way to move property, but it comes with a major catch: it offers no guarantees about the title's history.

Think of it this way: a quitclaim deed says, "I am giving you whatever interest I have in this property, if any." If the grantor owns the property free and clear, that’s what gets transferred. But if they have zero ownership interest, or if the title has liens or other claims against it, that’s what the grantee receives—problems and all.

This is the key difference from a warranty deed, which is what you'd use in a typical home sale. A warranty deed guarantees the grantor holds a clear title and will defend it against any future claims. A quitclaim offers no such protection for the grantee.

When Does a Quitclaim Deed Make Sense?

So, why would anyone use one? A quitclaim deed is incredibly useful in situations where the parties already have a high level of trust and a formal, guaranteed sale isn't the goal. Most of the time, it's about changing the names on a title, not selling property to a stranger.

Here are a few classic, real-world scenarios where I see them used all the time:

Adding a spouse to a title: You get married and want to make your new spouse a legal co-owner of your home. A quitclaim is a simple way to get it done.

Gifting property to a family member: A parent wants to give their vacation cabin to an adult child. Instead of a complex sale, they can use a quitclaim to transfer their ownership.

Removing an ex-spouse after a divorce: As part of a divorce settlement, one spouse will often sign a quitclaim deed, surrendering their interest in the marital home to the other. This is a critical step in separating assets.

Transferring property into a living trust: For estate planning, people often move their real estate from their personal name into the name of their trust. A quitclaim deed is the standard tool for this.

Why Its Simplicity Can Be Risky

The biggest advantage of a quitclaim deed is its speed and simplicity. It lets you sidestep the expense and hassle of a full title search and insurance policies that accompany a traditional sale. We dive deeper into the benefits of using a quitclaim deed in our detailed article.

Key Takeaway: The lack of a warranty is what makes a quitclaim deed a double-edged sword. It's perfect for low-risk transfers built on trust but completely unsuitable for buying property from someone you don't know.

Deciding between a quitclaim and a warranty deed is a crucial step. Here’s a quick comparison to help you understand the core differences at a glance.

Quitclaim Deed vs Warranty Deed At a Glance

Feature | Quitclaim Deed | General Warranty Deed |

|---|---|---|

Title Guarantee | None. Transfers only the grantor's current interest, whatever that may be. | Full guarantee. Warrants the title is clear and defends against all claims. |

Grantee Protection | No protection against title defects or outside claims. | Maximum protection. The grantor is legally liable for title issues. |

Common Use Cases | Adding/removing family members, transferring to trusts, clearing up title "clouds." | Traditional real estate sales between unrelated buyers and sellers. |

Risk Level for Grantee | High. The grantee assumes all risks associated with the title's history. | Low. The grantee is protected by the grantor's legal promises. |

Ultimately, while quitclaim deeds are a popular and flexible tool across the U.S., their use should be limited to non-commercial scenarios where title issues are not a concern. For more on the different types and definitions of deeds, study.com offers a solid overview.

How to Prepare Your Quitclaim Deed Document

When it comes to drafting a quitclaim deed, precision is everything. This isn't like a casual IOU; it's a legal instrument that has to be airtight to be valid. One tiny mistake—a misspelled name, a typo in the property description—can derail the entire transfer or create a legal mess that’s expensive and stressful to fix later on.

The goal here is a clean document with zero ambiguity. While you can find plenty of templates online, remember that every state has its own unique formatting rules and required language. Grabbing a generic form is a gamble, as it might be missing a critical detail for your area, making it completely useless.

Identifying the Parties Correctly

First things first, you need to get the grantor and the grantee perfectly identified. These aren't just names; they are legal identifiers that must line up exactly with official records.

The grantor is the person currently on the title who is transferring their ownership interest. The grantee is the one receiving it. It's absolutely vital to use their full, legal names—no nicknames, no shortcuts. If their driver's license or the previous deed includes a middle initial, you must include it, too.

For example, if the grantor's legal name is "Jonathan A. Smith," don't write "John Smith." That small difference is often enough for a county recorder to reject the document or cloud the title down the line. You'll also need to include the current mailing addresses for both parties, as this is standard for tax records and any official notices.

The All-Important Legal Property Description

This is, without a doubt, the spot where most DIY deeds go off the rails. You can't just use the street address. A legal document demands the official legal property description, which is a highly specific, formal description that uniquely identifies that exact piece of land.

Think of it as the property's unique fingerprint. It usually includes details like:

Lot, block, and subdivision names from a recorded plat map

Section, township, and range numbers from a government survey

Metes and bounds, which describe the property's boundary lines using directions and distances

Pro Tip: The best way to get this right is to find the most recent deed for the property—the one from when the grantor first took ownership. You can usually get a copy from your local county recorder's office. When you find it, copy the description exactly. Even a misplaced comma can cause a rejection.

Defining the Consideration

Every deed has to mention the consideration, which is simply what's being given in exchange for the property. In a standard sale, this is the purchase price. But with quitclaim deeds, money often isn't the main point of the transfer.

If you're gifting the property, like from a parent to a child, the consideration can be nominal. It's very common to see language like, "for the sum of ten dollars ($10.00) and other good and valuable consideration." This small amount satisfies the legal requirement to show an exchange took place. In Nevada, it’s also critical to be truthful on the Declaration of Value form about whether it's a gift, as this directly impacts potential transfer taxes.

Essential Wording and Vesting

The deed needs clear conveyancing language showing the grantor's intent to actually transfer their interest. You'll see standard phrases like "do hereby remise, release, and forever quitclaim," which gets the job done.

You also have to specify how the new owner (or owners) will hold title. This is called vesting. It’s especially important when there's more than one grantee.

For example, will they be "joint tenants with right of survivorship," where the surviving owner automatically gets the whole property? Or will they be "tenants in common," where each owner's share can be willed to their own heirs? This choice has major implications for estate planning, so it’s not a detail to gloss over.

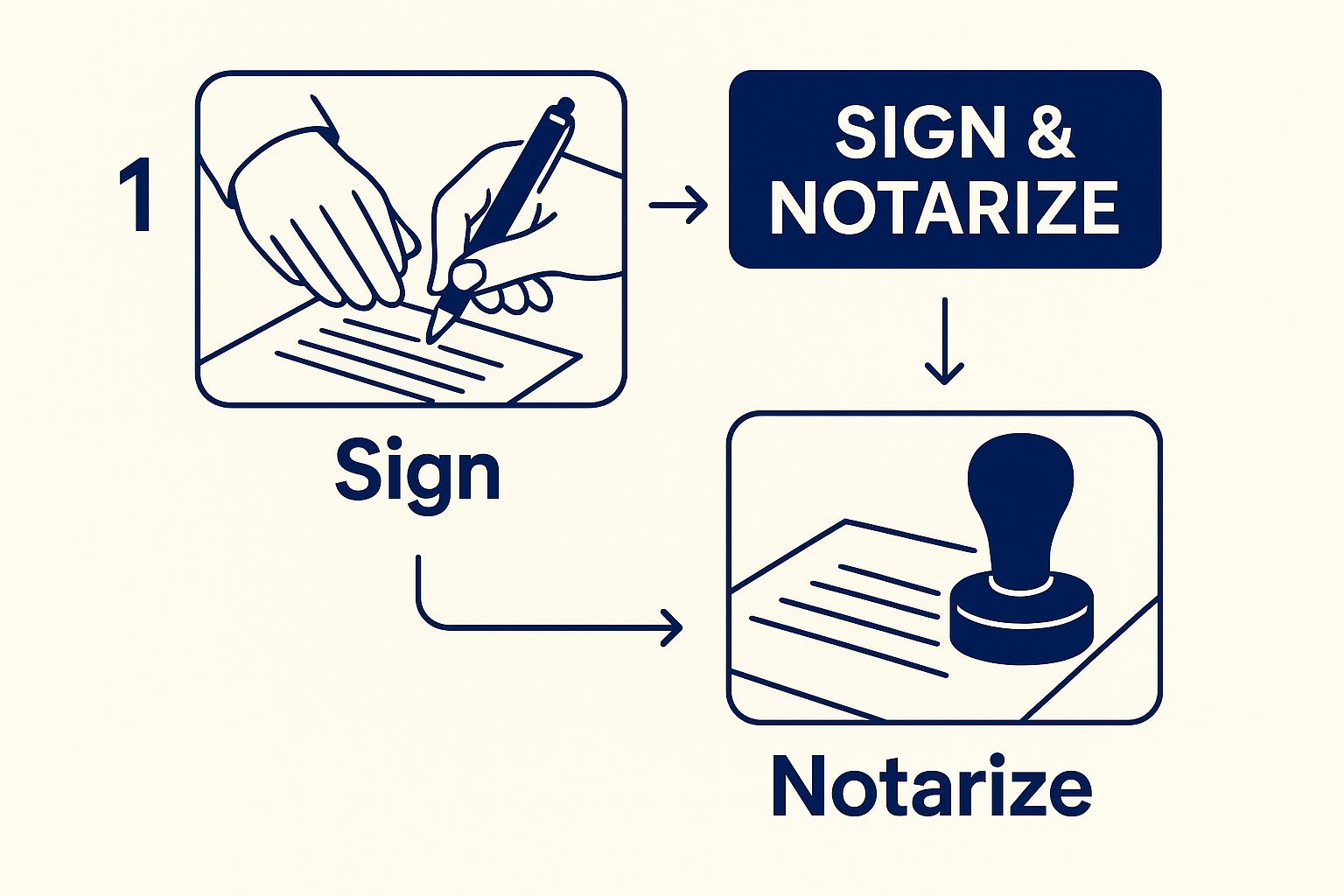

The Correct Way to Sign and Notarize Your Deed

Alright, you've got your quitclaim deed filled out and double-checked. Now comes the part that makes it all official: the signing and notarization. This is more than just scribbling your name on a dotted line. It's a formal step, and getting it wrong can invalidate the entire document.

I can't stress this enough: do not sign the deed before you meet with the notary. I've seen this happen countless times, and it’s a classic mistake that will get your document rejected flat out. The whole point of a notary is to witness you signing the document and confirm it was really you. A pre-signed deed is worthless to them.

Messing this up means the county recorder will send you packing, and you'll have to start the signing process all over again.

Understanding the Notary's Role

So, what does a notary public actually do? Think of them as an impartial, state-licensed witness. They aren't there to give you legal advice or check your deed for accuracy. Their job is very specific and absolutely critical.

A notary is responsible for a few key things:

Verifying Your Identity: They will ask for a valid, government-issued photo ID. This is how they know you are who you claim to be.

Confirming You're Willing: The notary makes sure you're signing the document freely, without anyone pressuring you.

Witnessing the Signature: This is the main event. They have to physically watch you sign the deed.

Completing the Notarial Certificate: Once you've signed, the notary will fill out their section, apply their official stamp or seal, and log the event in their official journal.

A notarization isn't just a fancy stamp. It's a legal confirmation that the signature on your document is authentic. This simple but vital act is what prevents fraud and gives the property transfer its integrity.

This image perfectly captures that critical moment where the signature and the notary's verification come together.

It's this combination—your signature under the watchful eye of a notary—that creates a legally solid document.

What to Bring to Your Notary Appointment

To keep things moving smoothly, show up to your notary appointment prepared. It’s pretty simple, but you'll need a couple of essential items.

Your ID is non-negotiable. Make sure you bring a current, government-issued photo ID.

Commonly accepted forms include:

A state-issued driver’s license or ID card

A U.S. passport

A U.S. military ID card

Your ID must be current—not expired. A cracked license with a blurry photo might get rejected, so double-check that it's in good shape. And of course, bring the unsigned quitclaim deed with you. Many people also bring a spare copy for their own files, which is a smart move.

With modern tech, you don't always have to meet in person. Many states now allow for virtual notary appointments. If you're interested in that route, you can find everything you need to know in our comprehensive guide on getting documents notarized online.

State-Specific Signing Requirements

While the basics of notarization are consistent across the country, some states add their own twists. For example, some jurisdictions require one or even two witnesses to be present along with the notary. These witnesses also have to sign the deed, and they can't be you (the grantor) or the person receiving the property (the grantee).

Here in Nevada, for example, you have an extra piece of homework. Every quitclaim deed must be submitted with a Declaration of Value form. This is a separate document where both the grantor and grantee state the value of the property being transferred. It's used to figure out if any transfer taxes are owed. If you forget this form, the recorder's office will reject your deed on the spot.

Before you head to the notary, always do a quick search for your state and county's specific rules. A little-known local requirement can easily trip you up and cause major delays.

Recording Your Deed and Making the Transfer Official

You’ve got the signed and notarized quitclaim deed in hand. It feels like you've crossed the finish line, but there's one critical step left. That document, sitting in a desk drawer, doesn't actually change the official property record. To truly finalize the transfer, you have to record the deed with the right government office.

Recording is the formal process of filing your executed deed with the county agency that manages all real estate records. This is what makes the ownership change public knowledge. Until that deed is recorded, the transfer is essentially invisible to the world—title companies, lenders, and future buyers won't see it. The grantee's new ownership isn't secure without this final, official act.

Think of it this way: the signed deed is the car title you just got from the seller. Recording it is like going to the DMV to have the title officially registered in your name. Without that registration, you can't legally prove you're the new owner.

Finding the Right County Office

Your first mission is figuring out exactly where to file. In most places, this is the County Recorder's Office, but you might see it called the County Clerk, Register of Deeds, or Land Registry Office depending on where you are.

What matters is that you file in the county where the property is located, which isn't always where the grantor or grantee lives.

Finding the office is usually simple. A quick search for "[County Name] county recorder" will almost always get you to their official website. These sites are goldmines of information, packed with physical addresses, mailing instructions, business hours, and—most importantly—their specific filing rules.

Understanding the Costs: Recording Fees and Taxes

Filing a deed isn't free, but the good news is that it’s generally affordable. The low cost of the quitclaim deed process is a big part of its appeal. Recording fees are usually between $20 and $100, though this can vary by county. Many recorder websites even have online fee calculators to give you a precise number. You can find more details on why quitclaim deeds are a budget-friendly option from NerdWallet.

Beyond the standard fee, you need to be aware of potential taxes.

Transfer Tax: Many states and local governments charge a real estate transfer tax. However, there are often exemptions, especially for transfers between close relatives (like a spouse, parent, or child) or when you're moving property into a personal living trust.

Gift Tax: If the property is a gift and its value is over the annual federal gift tax exclusion amount, the grantor might need to file a gift tax return with the IRS. For most people, actually paying a tax is rare because of the very high lifetime exemption.

The county recorder’s website is your best resource for local transfer tax information and any extra forms you'll need, like Nevada’s required Declaration of Value form.

Submitting Your Documents

With your original, notarized deed and any other necessary paperwork ready, it's time to file. Most recorder's offices give you a few options. Filing in person is often a great choice, as a clerk might give your documents a quick once-over for any obvious mistakes. Mailing them is also common; just be sure to use a service with tracking so you have proof of delivery.

Expert Tip: The recorder's office doesn't keep your original deed forever. They scan it into their official system, stamp it with a unique document number and the exact recording date and time, and then mail the original back to the person or address listed on the deed. This can take a few weeks to arrive.

Common Quitclaim Deed Mistakes and How to Avoid Them

A quitclaim deed seems straightforward, but it’s surprisingly easy to get wrong. And the consequences can be a real headache. A simple mistake can render the whole transfer void or create a "cloud on the title"—a legal snag that could cost a fortune to fix years later. So, let’s walk through the most common blunders I see and how you can steer clear of them.

Most of these errors are born from simple sloppiness, like typos or incomplete details. One of the top reasons a county recorder will reject a deed is a misspelled name or a partial address for the person giving or receiving the property. Always use full, legal names, exactly as they appear on a government ID. No shortcuts.

Using an Incorrect Property Description

This is a big one. Probably the most critical error you can make is messing up the legal property description. This is not the mailing address. The legal description is a specific, formal chunk of text that uniquely identifies a piece of land, often including details like the lot, block, and subdivision name.

If you just write down the street address, I can almost guarantee the recorder's office will send it right back to you. The only surefire way to get it right is to copy the legal description word-for-word from a previous deed for that exact property. Even a single typo or a misplaced comma can invalidate the document or, in a worst-case scenario, accidentally transfer a different piece of land.

Forgetting Key Signatures

It sounds basic, I know. But you'd be shocked how many deeds I've seen with missing signatures. If the property is owned by more than one person—say, a married couple or a pair of business partners—then every single owner on the current title has to sign the quitclaim deed as a grantor.

If only one of two co-owners signs, the deed doesn't transfer the whole property. It only transfers that one person’s share, leaving the new owner with a tangled mess of partial ownership. Before you go anywhere near a notary, double-check who the current owners are and make sure every last one of them is ready to sign.

This whole idea of clearing up ownership isn't new. Back in the 19th century, quitclaim deeds were essential when landowners passed away without a will. Courts used them to figure out who the legal heirs were and clarify property rights when formal records were spotty. It shows just how long this document has been a crucial tool, especially in managing estates. You can read more about the historical use of quitclaim deeds on this genealogy blog.

Misunderstanding the Mortgage Obligation

This is probably the most costly mistake people make. There's a widespread and dangerous assumption that signing a quitclaim deed also removes your name from the mortgage. That couldn't be more wrong.

CRITICAL WARNING: A quitclaim deed does absolutely nothing to your mortgage loan. The mortgage is a completely separate contract you have with your lender. If your name is on the loan documents, you are still legally on the hook for the payments, even if you no longer own the property.

Getting your name off a mortgage typically requires the person keeping the house to refinance the loan in their name alone. This means they have to qualify for a brand-new loan based on their own income and credit. Ignoring this can wreck the grantor's credit and lead to serious financial trouble down the line.

Here’s the breakdown:

Quitclaim Deed: Changes who has ownership of the property.

Mortgage Note: Determines who has liability for the loan.

These two are completely independent. Always deal with the mortgage as a separate issue from the property transfer to avoid a financial nightmare.

Got Questions About Quitclaim Deeds? You're Not Alone.

When you're dealing with something as important as a property title, questions are going to come up. It’s only natural. While we've walked through the main process, there are a few common "what ifs" and "hang on a second" moments that trip people up.

Let's clear the air on some of the most frequent questions I hear from clients. Getting these details right is what separates a smooth transfer from a future headache.

Will a Quitclaim Deed Get My Name Off the Mortgage?

This is, without a doubt, the biggest and most dangerous misconception about quitclaim deeds. The answer is a hard no.

A quitclaim deed deals strictly with ownership—who has a claim to the physical property. Your mortgage, on the other hand, is a completely separate contract with your lender that deals with debt. Signing away your ownership does absolutely nothing to erase your financial obligation. If your name is on that loan, you are still on the hook for the payments until it's paid off or refinanced.

Think of it this way: the deed is about who holds the keys, while the mortgage is about who owes the bank.

Crucial Point: To get your name off a mortgage, the other person almost always has to refinance the loan entirely in their own name. This means they have to qualify for a brand-new loan based on their own credit and income, which isn't always possible.

What About Taxes? Am I Going to Get a Big Bill?

Tax implications are a real concern, but they often aren't as scary as people think, especially for common scenarios. It really boils down to two main areas: gift tax and transfer tax.

When you transfer property for free (like to a child or an ex-spouse), the IRS sees it as a gift. The good news? Most people will never actually pay a gift tax. The IRS gives everyone a generous annual exclusion ($18,000 for 2024) and a massive lifetime exemption. You'll likely just have to file a form to report the gift, but you probably won't owe a dime.

The tax you’re more likely to encounter is the real property transfer tax (sometimes called a documentary or deed transfer tax).

This is a state or local tax on the transfer of real estate.

The amount is usually a small percentage of the property's value.

Big exceptions often apply! Many states, including Nevada, exempt transfers between spouses, from a parent to a child, or into a family trust.

In Nevada, for example, you have to fill out a Declaration of Value form. This document tells the county recorder whether the transfer is taxable or if it qualifies for one of these common exemptions. Always check your local rules first.

Can I Just Do This Myself?

Technically, yes. You can find a blank quitclaim deed form online and fill it out yourself. For an extremely simple transfer where everyone is on the same page—say, you're adding a spouse to your title—this might seem tempting.

But I've seen the DIY approach go wrong too many times. A quitclaim deed is a legal instrument, and small mistakes have big consequences. A typo in the legal description, using the wrong witness or notary language for your state, or failing to meet specific margin requirements can get your deed rejected by the recorder's office or, worse, invalidated down the road. Fixing a botched deed is a far bigger and more expensive problem than getting it done right the first time.

If your situation involves a divorce, multiple owners, or anything beyond the most basic scenario, getting professional help isn't just a good idea—it's cheap insurance.

Navigating the details of a quitclaim deed, from the initial drafting to the final recording, demands precision. For peace of mind that every "i" is dotted and "t" is crossed, Signature on Demand provides expert document preparation and notary services. Our Las Vegas-based team can ensure your property transfer is handled accurately and professionally. Visit us at https://signatureondemand.net to see how we can help.

Comments