Mortgage Loan Notary: Your Guide to Seamless Closings

- WebsiteFix Technical Partner

- Jul 15

- 14 min read

A mortgage loan notary is a state-commissioned Notary Public, often with specialized training as a Notary Signing Agent, who verifies your identity and witnesses your signature on loan documents during a real estate closing. Their role is to ensure every signature is authentic and properly executed, making your home purchase or refinance legally binding.

The Notary's Role in Your Mortgage Closing

Let's be honest, that final stack of closing documents can feel a little intimidating. Sitting right there with you, whether in person or on a screen, is the mortgage loan notary—a professional who does far more than just apply a stamp. They are the impartial, state-appointed witness tasked with overseeing the signing of some of the most significant financial documents of your life.

Their most critical job is to prevent fraud. They do this by carefully verifying the identity of every single person signing the paperwork. This isn't just a formality; they are confirming you are who you claim to be and that you're signing everything willingly, without being pressured. This identity verification is what gives the entire transaction its legal integrity.

Key Takeaway: It's crucial to remember that the notary isn't your lawyer or financial advisor. Their lane is strictly the formal signing process. If you have any last-minute questions about your interest rate, loan terms, or specific fees, you need to direct those to your loan officer before you put pen to paper.

Finding a Notary That Fits Your Life

The days of everyone having to troop down to a title company's office for closing are fading. The real estate world has adapted, and now you have flexible options that fit modern, busy schedules.

Mobile Notaries: These notaries are pros on the go. They’ll meet you wherever is most convenient—your home, your office, or even a local coffee shop—to handle the signing. It’s a huge time-saver.

Remote Online Notarization (RON): This is the high-tech option. Using secure audio-visual software, you can complete the entire notarization from anywhere with an internet connection. You and the notary meet in a secure virtual "room" to sign everything electronically.

This isn't just a niche trend; it's a massive shift. The global market for Remote Online Notary services was valued at around USD 101 million and is expected to skyrocket to USD 339 million as more of the real estate industry embraces efficient eClosings.

Comparing Notary Options for Your Closing

Choosing how you want to handle your signing appointment comes down to what works best for you. Here’s a quick breakdown of the different notary services available for your mortgage closing.

Feature | Traditional In-Office Notary | Mobile Notary | Remote Online Notarization (RON) |

|---|---|---|---|

Location | Fixed office (e.g., title company, bank) | Location of your choice | Anywhere with an internet connection |

Scheduling | Rigid, during business hours | Highly flexible, including evenings/weekends | Very flexible, often with 24/7 availability |

Convenience | Low - requires travel | High - notary comes to you | Highest - no travel required |

Technology | Pen and paper | Pen and paper | Computer, webcam, and internet |

Each option gets the job done right, but the convenience factor varies quite a bit. Think about your schedule and comfort level with technology when making your decision.

Ultimately, whether you meet your notary in an office, at your kitchen table, or through a screen, their fundamental role remains the same: protecting the integrity of your transaction. To get a better grasp of just how vital this role is, you can learn more about the importance of a notary public for legal documentation and the legal framework they operate within.

How to Prepare for Your Notary Signing Appointment

Showing up to your signing appointment prepared can make all the difference, turning what could be a stressful moment into a simple, confidence-building final step. A little bit of planning ahead of time is truly the secret to a smooth closing, making sure there are no last-minute hiccups when your notary arrives.

First things first, let's talk communication. Your lender or title company is usually the one who lines up the notary, but you should always get their contact information ahead of the meeting. Don't be shy about reaching out to confirm the essentials: the exact time, the location, and precisely what you need to have with you. Thankfully, this part of the process has gotten incredibly easy, especially with mobile notaries who come directly to you. You can learn more about how mobile notaries make document signing easier and fit right into your schedule.

Verify Credentials for Peace of Mind

Even though your lender has already done their homework, a quick check can give you an extra layer of confidence. Most states offer a public online database where you can look up a Notary Public using their name or commission number. It only takes a minute to confirm their commission is active and that they're in good standing.

A Notary Signing Agent (NSA), the specialist you’ll be meeting, will also have certifications from professional bodies like the National Notary Association. This isn't just a piece of paper; it means they have specific training to navigate that thick stack of mortgage documents you're about to sign.

Your Essential Signing Appointment Checklist

Walking up to the signing table (even if it’s your own kitchen table) with everything in hand is the best way to keep things moving without any stress or delays.

Here’s what you absolutely must have:

Valid Photo Identification: This is the big one. Your government-issued ID, like a driver's license or passport, cannot be expired. Critically, the name on your ID must exactly match the name printed on your loan documents. No exceptions.

The Closing Disclosure: By law, you should get this document at least three business days before your scheduled closing. It spells out every final dollar amount for your loan.

Any Required Funds: You'll likely need a cashier's check or proof of a completed wire transfer to cover your closing costs and down payment. Be sure to confirm the exact amount and the acceptable payment method with your closing agent well beforehand.

Pro Tip: If you do only one thing, do this: Review your Closing Disclosure the moment you get it. Pull up your original Loan Estimate and compare them side-by-side. If anything looks off or raises a question, call your loan officer immediately—not while the notary is waiting.

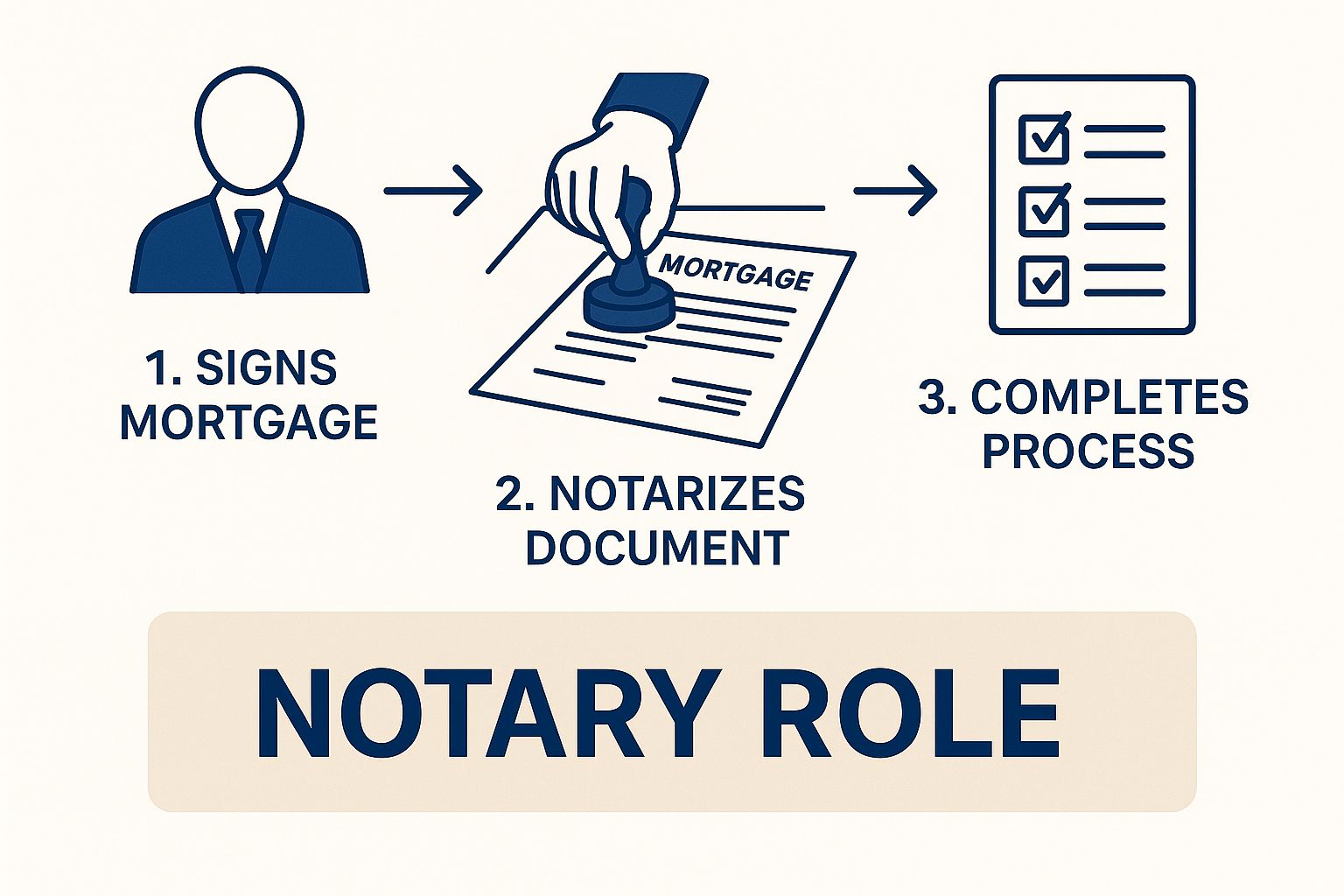

This visual helps clarify the notary's specific and crucial role in the signing process. They are there as an impartial witness to the transaction.

As the image highlights, the notary's job is all about verifying your identity and witnessing your signature. Think of them as the final checkpoint on your home loan journey. When you come prepared with your documents in order, you enable the notary to do their job efficiently, which is the key to a quick and painless closing day.

What to Expect During the Loan Signing

The moment the mortgage loan notary walks through your door or appears on your screen for a virtual session, the closing process is officially underway. It doesn't matter if you're sitting at your kitchen table or in a formal office; the notary's first job is always the same: verifying who you are and ensuring you're signing without being pressured. This step is the foundation of the entire closing.

They'll begin by asking for the valid, government-issued photo ID you set aside earlier. This isn't just a casual glance. The notary will meticulously compare the photo, name, and signature on your ID with the person in front of them and the name printed throughout the loan documents. It’s a crucial fraud-prevention measure required by law.

With your identity confirmed, it’s time to tackle the paperwork. You’ll be face-to-face with a hefty stack of documents, often between 100 and 150 pages. It looks intimidating, but the notary is there to guide you. They will walk you through the stack page by page, pointing out every single line that needs a signature, initial, or date.

The Signing Flow and Key Documents

As you go, the notary will typically announce the title of each document. While they're legally barred from explaining the legal nuances or financial terms of your loan, they can give you a general, high-level description of what a particular document is for.

You'll sign a lot of papers, but a few carry the most weight. Be on the lookout for these headliners:

The Promissory Note: This is it—your official, legally binding promise to repay the loan. It clearly states the total amount you borrowed, your interest rate, and your full repayment schedule.

The Deed of Trust (or Mortgage): This document is what secures your property as collateral for the loan. It gives your lender the legal right to foreclose if you don't make payments as agreed.

The Closing Disclosure: You will have seen a preliminary version of this document before, but you’ll sign the final, official version at the closing table. This is the definitive, itemized breakdown of every cost and fee associated with your loan.

Patience is your best friend during this part of the process. Don't let yourself feel rushed. Take the time you need to sign clearly and, most importantly, consistently. Your signature needs to match how your name is printed on the documents. So, if the documents read "Jane A. Doe," you must sign "Jane A. Doe"—not "Jane Doe" or "J.A. Doe."

Expert Tip: A notary is a state-appointed impartial witness, not your lawyer or lender. They are prohibited from offering advice or interpreting the documents for you. If a question about your interest rate, a specific fee, or a loan term pops into your head, you need to direct it to your loan officer or closing agent immediately.

The Growing Demand for Notary Signing Agents

The role of the Notary Signing Agent (NSA) has become incredibly important, especially with the current dynamics in the housing market. Major demographic shifts, like the anticipated 15.9 million new households expected to be formed by baby boomers and millennials, are set to significantly increase housing demand. Projections show that up to 80 percent of these new households will eventually become homeowners, which means the need for experienced professionals to handle all those loan signings is only going to grow. You can read more about these housing market trends and their impact on the notary profession.

After you've signed the last page, the notary will do one final check to make sure no signatures or initials were missed. Then, they will complete their own part of the process: filling out the notarial certificates on the required documents and affixing their official seal and signature. This is the act that makes your signatures legally binding.

Once everything is signed, sealed, and double-checked, the notary will package the entire document set securely for its trip back to the title company or lender. You're now just one step away from getting the keys to your new home.

Understanding Your Key Mortgage Documents

Let's be honest: that stack of closing documents can be intimidating. It often looks like a small mountain of paperwork filled with dense legal language. But here's the secret—you don't need to be a lawyer to understand it. You just need to know which documents truly matter.

Having a little know-how before you sit down to sign makes all the difference. It transforms the experience from a stressful, robotic signature session into a confident, informed final step. While a good mortgage loan notary will absolutely walk you through the package, coming prepared is your single greatest advantage.

Think of it this way: out of a hundred or more pages, only a handful do the real heavy lifting. These are the documents that define your loan, secure the property, and finalize the costs.

The Big Three Loan Documents

At the core of every mortgage transaction, you'll find three critical documents. These are the ones that legally bind you to the loan and give the lender their security interest in your home.

The Promissory Note: This is it—your official, legally binding promise to pay back the loan. It’s the "IOU" of the mortgage world, spelling out the exact amount you borrowed, your interest rate, how long you have to pay it back (the term), and your monthly payment schedule.

The Mortgage or Deed of Trust: This is the document that uses your new home as collateral for the Promissory Note. It gives the lender the legal right to take possession of the property through foreclosure if you stop making payments. The name changes depending on your state, but its purpose is always the same.

The Closing Disclosure (CD): You'll see a final version of this at your signing. This five-page form is the ultimate summary of your loan's financial details. It itemizes everything from your loan amount and interest rate to all the closing costs and prepaid expenses. Most importantly, it confirms the final "cash to close" amount you'll need to provide.

Your signature on these documents is what makes everything official. Understanding them turns the signing from a mechanical task into a deliberate, confident act. There should be zero surprises when you sit down at that table.

If you want an even deeper look, our comprehensive **mortgage document checklist for 2025 offers essential tips** to help you organize and review everything ahead of time.

Other Important Forms to Know

Beyond that main trio, a few other forms are worth your attention. If you're refinancing, one of the most powerful is the Notice of Right to Cancel. This gives you a three-business-day "cooling-off" period after you sign to cancel the entire transaction with no penalty. It’s a valuable protection.

You’ll also encounter documents like the initial escrow disclosure statement, W-9 forms for the IRS, and several affidavits. These are simply sworn statements where you confirm certain facts, like that you plan to live in the home as your primary residence.

A Homeowner's Guide to Key Loan Documents

To make it even simpler, here's a quick-reference table summarizing the most important documents you'll see at the closing table.

Document Name | Its Purpose in Plain English | What to Double-Check Before Signing |

|---|---|---|

Promissory Note | Your formal promise to repay the loan. | Verify the loan amount, interest rate, and that the rate is fixed or adjustable as expected. |

Deed of Trust/Mortgage | Secures your property as collateral for the loan. | Confirm the property address and legal description are 100% accurate. |

Closing Disclosure | The final, detailed breakdown of all costs. | Check that the "cash to close" amount matches what you were told and scan for any unexpected fees. |

Notice of Right to Cancel | Your three-day window to cancel a refinance. | Confirm the final date of the rescission period is correct. |

Getting familiar with these key pieces of the puzzle beforehand lets you focus your attention where it counts. You can work efficiently with your mortgage loan notary and walk away from your closing with complete peace of mind.

So, you've signed the last page and the notary is packing up their bag. That feeling of relief is huge, but you're not quite at the finish line just yet. The heaviest lift is definitely behind you, but a few important things need to happen behind the scenes before you get the keys or your refinance officially wraps up.

Once your signing appointment is over, the notary's first job is to get that stack of signed papers back to the title company or lender, safe and sound. They'll do a final, careful sweep of every single page, looking for any missed signatures or initials before packaging it all up and sending it off, usually via a priority courier.

This step is more critical than it sounds. The whole mobile notary field has exploded precisely because the real estate and financial worlds need this kind of reliable, secure document handling. In fact, the Mobile Notary Service Market was already valued at USD 0.4 billion and is expected to keep growing, largely thanks to real estate closings. You can dig into the growth of the mobile notary market if you're curious about the data behind this trend.

Funding and Recording: Making It Official

Once the signed package lands back at the title company, they'll review it for accuracy. If everything looks good, two major things happen next: funding and recording.

Funding: This is the moment your lender actually releases the money. If you're buying a home, the funds go to the title company, which then pays the seller and settles any other costs listed on your closing statement. Your loan is now live.

Recording: This is the final, official step that cements the deal. The title company takes the new deed (for a purchase) or deed of trust (for a refinance) down to the county recorder's office. This action makes your ownership of the property a matter of public record. It's the legal final stamp. Don't be surprised when the original recorded deed shows up in your mailbox a few weeks later.

A Quick Tip from Experience: The wait between signing and the official "funded and recorded" status is usually short—often just 1-3 business days for a home purchase. Your closing agent or loan officer should be your go-to for any updates during this brief period. Don't hesitate to reach out.

The Special Three-Day Wait for a Refinance

Now, if you just refinanced your primary home, there's a unique rule you need to know about. Federal law gives you what's called the three-day right of rescission.

Think of it as a mandatory cooling-off period. It starts the day after you sign and runs for three full business days (Saturdays count, but Sundays and federal holidays don't). During this window, you have the right to cancel the whole refinance for any reason at all, no questions asked and no penalty. Because of this, your loan won't actually fund until this rescission period is over.

Common Questions About Mortgage Notaries

Even after you've dotted the i's and crossed the t's on your mortgage application, some questions are bound to pop up about the final signing. Real estate closings have a language all their own, and it's completely normal to want clarity on the last few details.

Let's walk through some of the most frequent questions people have about the role of a mortgage loan notary. Getting these answers sorted out now will help you walk into your signing appointment with confidence.

Can I Choose My Own Mortgage Loan Notary?

This is a great question, but the short answer is usually no. In most cases, your lender or the title company will select a Notary Signing Agent from their own network of trusted professionals.

There's a good reason for this: compliance. Lenders and title companies need to guarantee that the notary handling your closing is not just certified, but also properly insured with Errors & Omissions coverage and has a clean, recent background check. It's all about protecting the integrity of the transaction.

While you likely can't handpick the person, you absolutely have the right to verify their credentials. Don't hesitate to ask for the notary's name and commission number to look them up with the state. If you have a qualified notary you prefer, you can certainly ask the lender, but just know they often stick to their pre-vetted list.

What's a Notary Signing Agent (NSA)? It’s important to know that an NSA is more than a standard Notary Public. While every NSA is a notary, not every notary has the specialized training to be an NSA. They are certified to guide you through a complex stack of loan documents, making sure everything is signed and dated correctly without giving any legal or financial advice.

What If I Find a Mistake on a Document?

First, take a breath. It happens. If you spot an error—a misspelled name, the wrong interest rate, an incorrect address—the most important thing to do is stop and do not sign that particular document.

Your job is to bring the mistake to the notary's attention immediately. They'll then help you contact your loan officer or closing agent. The notary is legally forbidden from altering the documents themselves; any corrections must come directly from the lender.

Yes, this might cause a slight delay as the lender has to generate a corrected document. But trust me, it's far better to wait a little longer for an accurate document than to deal with the major headaches an incorrect one can cause later on. Accuracy is paramount.

How Much Does the Notary Cost?

You won't pay the notary directly out of your pocket at the signing table. The fee for their service is one of the standard closing costs.

Look for a line item on your final Closing Disclosure labeled "signing agent fee" or "mobile notary fee." This cost typically ranges from $150 to $250. The exact amount can depend on a few things:

Your location (fees vary by market).

The size and complexity of your loan package.

Travel time for a mobile notary coming to you.

This fee covers the signing agent's professional expertise, their travel, and the immense responsibility they carry to ensure your closing is executed perfectly and legally. It's a small but critical cost for the peace of mind that comes with a properly finalized home loan.

Navigating your loan signing is a crucial step on your path to homeownership. For professional, reliable, and convenient notary services in Las Vegas and beyond, Signature on Demand is here to help. Whether you need a mobile notary to meet you at your convenience or a secure Remote Online Notarization, we ensure your documents are handled with the utmost care and professionalism. Visit us at https://signatureondemand.net to learn more.

Comments