Essential Estate Planning Documents You Need Today

- WebsiteFix Technical Partner

- Jul 23, 2025

- 16 min read

Imagine leaving your family a clear, thoughtful roadmap instead of a complicated puzzle. That’s exactly what estate planning documents do. They are your legally binding instructions, making sure your assets are managed and distributed precisely the way you want. Think of it as the ultimate instruction manual for your financial legacy.

Why Estate Planning Is Your Financial Lifeline

A lot of people think estate planning is just for the ultra-wealthy, but that's a dangerous myth. The truth is, if you have any assets at all—a home, a car, a bank account—or anyone who depends on you, then you have an estate. Without your clear instructions, the state's impersonal laws will decide what happens to everything you've worked so hard for. This often throws families into stressful, expensive, and public legal battles.

Good estate planning is how you stay in control, even when you're no longer able to speak for yourself. It’s a powerful way to protect the people you love from uncertainty and make sure your final wishes are honored.

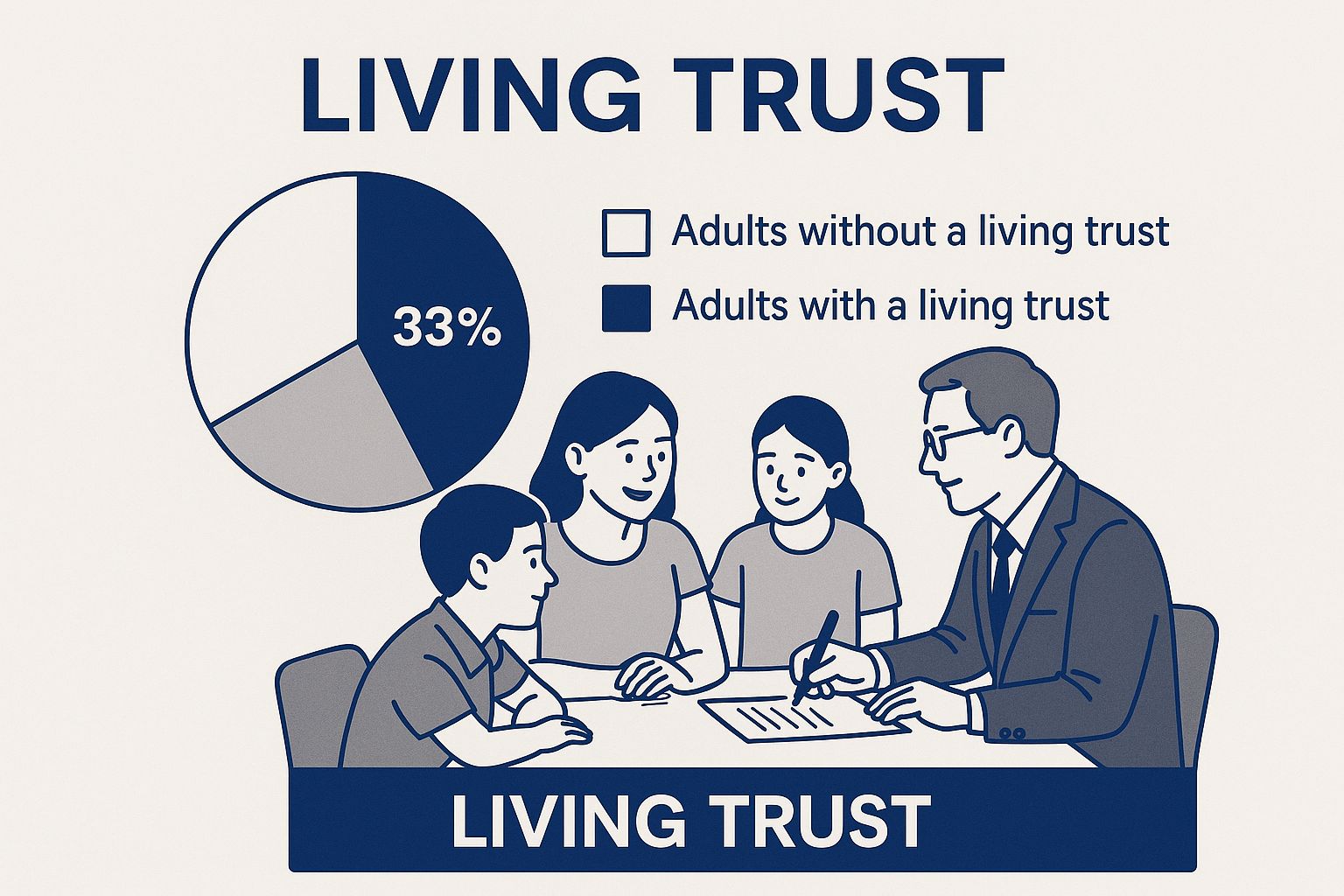

The Real Cost of Not Planning

The fallout from not having a plan can be immense. It might surprise you to learn just how many people put this off. In fact, current data for 2025 shows that only about 33% of Americans have created essential documents like a will or trust. That means nearly two-thirds of adults are leaving their families to navigate a messy and painful process.

Often, it takes a major life event to get people moving. For example, 43% of people say a health scare was the wake-up call that finally pushed them to write a will. You can learn more about what motivates people and see other key estate planning statistics in this detailed report.

Without a plan, your family is forced into a lengthy court process called probate. This is where a judge, a complete stranger, makes the final calls on your assets and even who will raise your minor children.

An estate plan isn't about expecting the worst. It’s about planning for the future and protecting the people you love from unnecessary hardship.

The Essential Documents in Your Toolkit

Before we dive into the details, it helps to see the main players at a glance. A solid estate plan isn't just one document; it's a collection of tools that work together to create a complete safety net for your family.

Key Estate Planning Documents at a Glance

Document Type | Primary Purpose | When It Is Used |

|---|---|---|

Last Will & Testament | To distribute property and name guardians for children. | After your death. |

Trust | To manage assets, avoid probate, and maintain privacy. | During your life and/or after your death. |

Power of Attorney | To appoint someone to handle your financial affairs. | If you become incapacitated. |

Healthcare Directive | To state your wishes for end-of-life medical care. | If you are unable to communicate your wishes. |

These core documents each serve a different but complementary purpose. For a deeper look at how they all fit together into a cohesive strategy, you can explore our guide on simplifying wills and estate planning.

Here’s a quick rundown of what each one does:

Last Will and Testament: This is the cornerstone of most plans. It clearly states who gets your property and, just as importantly, who you want to be the guardian for your minor children.

Trusts (Revocable or Irrevocable): Think of a trust as a private way to manage your assets. It can help your estate avoid the public probate process, maintain your family's privacy, and give you much more control over how and when your assets are distributed to your heirs.

Powers of Attorney: This document lets you appoint a trusted person—an "agent"—to manage your finances or make healthcare decisions on your behalf if you ever become unable to do so yourself.

Healthcare Directives (Living Will): This is where you outline your specific wishes for end-of-life medical care. It's a profound gift to your family, as it removes the agonizing burden of making those decisions for you.

The Last Will and Testament: Your Foundational Document

When people think about estate planning, the first thing that usually comes to mind is the Last Will and Testament. For good reason. It’s the cornerstone of any solid plan, the essential document that speaks for you when you no longer can. Think of it as your final, personal instruction manual for distributing your property.

If you pass away without one, you die "intestate." That’s a legal term for a situation where a court steps in and divides your assets based on generic state laws, not your wishes. It's an impersonal process that can easily lead to results you never intended, sparking conflict and heartache for the people you love most. A will ensures your voice is the one that matters.

More Than Just Who Gets What

A will’s power goes far beyond simply deciding who gets your savings account or your collection of vintage records. For parents with young children, it serves one of the most critical functions imaginable: naming a guardian. This is your opportunity to choose the person you trust to raise your kids if the unthinkable were to happen.

Without that direction, a judge who doesn't know you, your values, or your family will make that life-altering choice.

A will also appoints an executor—the person or institution you task with carrying out your instructions. Their job is to manage your estate, from paying off final bills and taxes to making sure your beneficiaries get what you left them. Choosing your executor is a big decision. They need to be responsible, organized, and trustworthy. It's a heavy lift, so always have a frank conversation with your choice beforehand to make sure they're up for the job.

A will is your legally binding directive that prevents strangers from making the most personal decisions for your family. It is the most direct way to protect your children and your assets according to your specific wishes.

Despite how crucial it is, a shocking number of Americans don't have this basic protection. A 2025 survey showed that the number of adults with a will is actually falling. Only about 24% of Americans had a will in 2025, a steep drop from 33% just a few years earlier. The decline was sharpest among parents with young children, the very people who often need one most.

Key Ingredients for a Valid Will

For a will to hold up in court, it has to meet certain legal standards that vary a bit from state to state. Getting these details right is what makes your will a shield against family disputes and legal challenges.

Here are a few common pitfalls to sidestep:

Vague Language: Using fuzzy terms like "my personal effects" is a recipe for arguments. Be specific. The more detail, the less room for interpretation.

Improper Signing: A will must be executed according to your state's laws, which nearly always involves signing it in front of witnesses who aren’t inheriting anything. One slip-up here can render the entire document useless.

Forgetting Assets: If you don't account for all your property, certain assets may fall into that "intestate" category. It's also worth knowing how different types of assets are treated. For example, to simplify how real estate is passed on, you might explore tools that complement your will. You can learn more about how a Transfer on Death Deed can simplify passing on real estate in our guide on the topic.

Crafting a clear, comprehensive, and legally sound will is the first and most vital step toward building a protective wall around your family's future. It's the foundation for everything else.

Using Trusts for Privacy and Control

While a will is a critical first step, it has one major drawback: after you pass away, it becomes a public record during the probate process. Anyone can walk into the courthouse and see exactly who got what.

If a will is a public roadmap to your estate, a trust is more like a private, secure vehicle you build to hold and transfer your assets. This powerful tool keeps your affairs out of the public eye and gives you far more control over your legacy.

Think of it like this: you, the grantor, create a rulebook and a lockbox. You put your assets inside the lockbox and hand the keys to a trustee—which can be you, at first—who must follow your rulebook. The people who eventually get the contents are your beneficiaries.

The image below shows a common family scenario, with a living trust at the center of their estate planning conversation.

As you can see, setting up a trust is often a collaborative effort to manage assets privately and efficiently. The biggest win? Your estate can completely sidestep the probate court process, saving your family significant time, money, and stress.

Will vs. Revocable Living Trust Comparison

Deciding between a will and a revocable living trust can feel overwhelming. Both are essential estate planning documents, but they serve different primary purposes and operate in fundamentally different ways. The right choice really depends on your specific goals for privacy, control, and efficiency.

This table breaks down the key differences to help you see which one might be a better fit for your situation.

Feature | Last Will and Testament | Revocable Living Trust |

|---|---|---|

Probate | Required. The will must be validated by the court. | Avoids probate. Assets are distributed privately by the trustee. |

Privacy | Public record. Anyone can view the will and asset distribution. | Private. The terms of the trust are not filed with the court. |

Control if Incapacitated | None. A power of attorney is needed for management. | Seamless. A successor trustee takes over management immediately. |

Cost to Create | Generally lower initial cost. | Higher upfront cost to create and fund the trust. |

Cost to Settle | Can be expensive due to court fees, attorney fees, and delays. | Generally less expensive to settle as there are no court costs. |

Effectiveness | Only takes effect upon your death. | Takes effect as soon as you create and fund it. |

While a trust has a higher upfront cost, it often saves your family much more in the long run by avoiding the lengthy and expensive probate process. For many, the privacy and control it offers are well worth the initial investment.

Revocable vs. Irrevocable Trusts

Trusts come in two main flavors, and knowing the difference is crucial. Your choice here strikes a balance between flexibility and protection.

Revocable Living Trust: This is the go-to for most people's estate plans. It's incredibly flexible—you can change it, add or remove assets, or even cancel it entirely whenever you want. Think of it as a plan written in pencil.

Irrevocable Trust: This one is a bigger commitment. Once you create it and move assets into it, you generally can't take them back or change the terms. It's a plan written in permanent ink. Why do this? It offers powerful protection from creditors and can significantly reduce estate taxes.

So, what’s the right call? If your main goal is to avoid probate and stay in the driver's seat during your lifetime, a revocable trust is almost always the answer. If you're dealing with a very large estate or have serious concerns about asset protection, an irrevocable trust might be the smarter strategic move.

A trust lets you fine-tune your legacy. You can dictate not just who inherits, but how and when—a level of detailed control that a will simply can't provide.

Practical Applications of a Trust

Beyond just skipping probate, trusts are remarkably versatile estate planning documents that can solve all sorts of real-world family challenges.

Here are a few ways people put trusts to work:

Caring for a Loved One with Special Needs: A Special Needs Trust can hold assets for a disabled family member. This gives them financial support without disqualifying them from critical government benefits like Medicaid or SSI.

Protecting Young Beneficiaries: Worried about an 18-year-old inheriting a large sum? A trust lets you appoint a trustee to manage the money until your child or grandchild reaches a more mature age, like 25 or 30, or hits a milestone like graduating college.

Navigating Blended Families: Trusts are a lifesaver for blended families. You can structure a trust to provide income for your surviving spouse for the rest of their life, and then, after they pass away, have the remaining assets go to your children from a previous marriage.

Ultimately, a trust helps you create a clear, private, and legally binding instruction manual for your legacy, ensuring your loved ones are cared for exactly the way you intend.

Planning for Incapacity with Powers of Attorney

While most people think estate planning is only about what happens after you die, that's only half the story. Some of the most crucial estate planning documents are designed to protect you while you’re still here, especially if you can't speak for yourself.

A comprehensive plan is about more than just your legacy; it's about protecting your autonomy if an illness or injury leaves you unable to make your own decisions.

This is where a Power of Attorney (POA) comes in. A POA is a legal document that lets you appoint a trusted person—often called an agent or attorney-in-fact—to make decisions for you. Think of it as designating a co-pilot for your life, someone you trust to take the controls if you’re suddenly unable to.

The Two Critical Types of POA

Powers of Attorney aren't a one-size-fits-all solution. They're specific tools for different parts of your life, and you really need two separate kinds to be fully covered.

Financial Power of Attorney: This gives your agent the authority to handle your money. We're talking about paying the mortgage, handling bills, managing investments, and even filing your taxes. Without this, your family could face a nightmare scenario where they’re locked out of your accounts, unable to pay for your care.

Medical Power of Attorney: Sometimes called a healthcare proxy, this empowers your agent to make medical decisions on your behalf. If you're unconscious or can't communicate, this is the person who will talk to doctors and consent to treatments, ensuring your care aligns with what you would have wanted.

Picture a sudden accident. Without these POAs in place, your loved ones would likely have to go to court and ask a judge to appoint a guardian. It’s a public, expensive, and stressful process, all at a time when they're already worried sick about you. A Power of Attorney avoids all that, keeping control with the people you chose.

The Power of a Durable POA

When you're creating these documents, there’s one word you absolutely must include: durable. A "standard" power of attorney can become invalid the moment you're declared incapacitated—which is exactly when you need it the most! A durable power of attorney, on the other hand, is specifically designed to remain in effect even if you're no longer mentally competent.

A durable power of attorney is your lifeline during a crisis. It ensures that the person you trust can step in immediately to manage your affairs without any legal delays or court intervention.

That "durable" clause is the key. It means your agent can instantly access your bank account to pay for medical bills or make time-sensitive treatment decisions based on conversations you've already had. It's a simple feature that prevents a legal and financial catastrophe when your family is already under immense pressure.

Choosing Your Agent and Finalizing the Document

Selecting your agent is easily the most important decision in this process. You need someone you trust without reservation—a person who is responsible, level-headed, and willing to accept this serious role. It's critical to have an open conversation with them first to make sure they understand what's involved and agree to act for you.

Once the document is drafted and your agent is on board, you have to execute it properly to make it legally binding. This almost always involves signing it in front of a notary public. As you prepare this vital document, you can find a trusted notary for a power of attorney today to ensure it’s finalized correctly. That final signature and stamp are what turn your wishes into an actionable, legal plan.

Your Voice in Medical Decisions: Healthcare Directives and Living Wills

While your power of attorney names who will make decisions for you, your living will tells them what you want. These essential documents, often grouped together as healthcare directives, are your way of communicating your wishes for medical treatment if you ever become unable to speak for yourself.

Think of it this way: your medical power of attorney is the person you’ve chosen to be your voice. Your living will is the script you hand them, ensuring they know exactly what to say. This isn't about giving up control—it's the ultimate act of staying in control, even when you can't communicate.

Taking the time to do this now is a profound gift. It frees your family from the agonizing burden of guessing what you would have wanted during an already stressful and emotional time.

Spelling Out Your End-of-Life Wishes

A living will is where you get to think through some of life's most personal and sensitive questions in a calm, clear-headed way. It lets you provide specific instructions on what you want—and just as importantly, what you don't want—when it comes to your medical care.

Here are some of the key decisions you can spell out:

Life-Sustaining Treatment: Do you want machines like ventilators or feeding tubes used to keep you alive if you’re in a terminal condition or a permanent vegetative state?

Do-Not-Resuscitate (DNR) Orders: If your heart stops or you stop breathing, should medical teams try to revive you with CPR?

Pain Management: You can state your preference for palliative care, which focuses on keeping you comfortable and pain-free, even if that means not pursuing every possible life-extending treatment.

A living will is one of the kindest documents you can prepare. It takes the guesswork and guilt away from your loved ones, empowering them to advocate for you with the confidence that they are simply honoring your stated wishes.

Why You Can’t Forget a HIPAA Release

There’s one more piece to this puzzle, and it's absolutely critical: the HIPAA Release Form. The Health Insurance Portability and Accountability Act (HIPAA) is a federal law designed to keep your medical information strictly private.

Without a signed release, doctors can’t legally share any details about your condition with anyone. Not your spouse, not your adult children, and not even the agent you appointed in your power of attorney. This can bring the entire decision-making process to a grinding halt right when your agent needs information the most.

A HIPAA release gives your chosen agent the legal key to access your medical records and discuss your care with doctors. This is the only way they can make the truly informed decisions you’re trusting them with. Without it, the people you’ve chosen to help are left trying to do their job completely in the dark.

Your Modern Estate Plan: What About Your Digital Life?

Let's be honest, your life isn't just in filing cabinets anymore. A massive part of it exists online. We're talking about your digital assets—a whole new category of "stuff" that most traditional estate plans completely miss. This isn't just about financially valuable things like cryptocurrency or an online business. It also includes the sentimental treasures, like years of family photos on the cloud or your social media history.

Think about it for a second. Your will can pass down the family home, but what about your website's domain name or the login for your Bitcoin wallet? Old-school estate plans just weren't built for this. Without a specific game plan, all those digital assets could be lost for good, locked away behind passwords and encryption your family simply can't crack.

Why Your Digital Footprint Needs a Plan

If you ignore your online life in your estate plan, you're leaving a massive blind spot. And it’s not just about the money. The sentimental value tied up in decades of emails, photos, and social media memories is truly priceless. A modern approach to creating your estate planning documents absolutely has to include a strategy for these assets.

This is getting more important by the day. Experts predict a staggering $84 trillion will be passed down in the US alone by 2045, and a growing slice of that pie is digital. For example, about 80% of high-net-worth individuals now own digital assets like cryptocurrency. Here’s the scary part: fewer than 25% of Americans have actually named beneficiaries for those assets, which is a huge risk. You can explore more about these evolving trends in estate planning to see just how big this challenge has become.

How to Build Your Digital Asset Inventory

First things first: you need to create a digital asset inventory. This is basically a detailed list of everything you own or manage in the digital world. It's the map your family will desperately need to navigate your online life after you're gone.

So, what goes on this list? Start here:

Financial Accounts: Think online banking portals, PayPal, Venmo, and any brokerage accounts.

Cryptocurrency: List the wallets and exchanges you use, along with any crucial notes on accessing them.

Business Assets: This includes domain names, company websites, customer lists, or e-commerce storefronts.

Social Media: Facebook, Instagram, LinkedIn—any platform where you have a profile.

Cloud Storage: Google Drive, Dropbox, iCloud, or wherever you keep photos, documents, and important backups.

Intellectual Property: Do you own digital art, receive music royalties, or have online publications? Write it down.

A digital estate plan is the bridge between your physical and online worlds. It ensures your executor can access, manage, and distribute your digital footprint according to your wishes, protecting both financial and sentimental value for your heirs.

Once you have this inventory, you need to figure out how to store it—and any related passwords—securely. It’s also a smart move to name a digital executor in your will. This is the person you officially trust and authorize to handle your online accounts. By giving them clear instructions, you empower them to safeguard your legacy and prevent your digital life from becoming an unsolvable puzzle for the people you love.

A Few Common Questions About Estate Planning

Even after you've got a handle on the basics, a few practical questions almost always pop up. Let's walk through some of the most common ones I hear from clients. Getting these details right is what helps you move forward with real confidence, knowing your plan is solid.

How Often Should I Update My Estate Plan?

The standard advice is to review your plan every three to five years, and that's a good rule of thumb. But honestly, it's less about the calendar and more about your life. Think of your estate plan as a snapshot of your life, your finances, and your family. When the picture changes, you need a new snapshot.

You should pull out your documents for a review immediately after any major life event, such as:

Getting married, divorced, or remarried

Welcoming a new child or grandchild

The death of someone named in your plan (like a beneficiary or executor)

A major shift in your finances—up or down

Moving to a different state, since inheritance laws can vary wildly

Keeping your plan current is the best way to make sure it actually does what you want it to do and avoids messy, unintended outcomes for your loved ones.

Can I Just Make My Own Will Online?

DIY legal websites are everywhere these days, and while they might seem like a cheap and easy fix, they carry some serious risks. Estate planning isn't a "one-size-fits-all" deal. Those templates just can't grasp the unique details of your family or the specific quirks of your state's laws.

Using a generic online form is like trying to use a standard key for a custom-built lock. It might look right, but it probably won’t work when you need it most, leaving your assets and family unprotected.

Working with an experienced professional is about getting personalized advice—something a form can never provide. They can help you think through tricky situations like blended families, providing for a beneficiary with special needs, or planning for business succession. A little investment upfront for professional guidance can save your family a world of heartache and expense down the road.

Where Should I Keep My Original Documents?

This is a critical detail people often overlook. Your original documents need to be stored somewhere that is both secure and accessible to your executor or trustee when the time comes. If they can't find the originals, it can throw your entire plan into question.

A fireproof safe at home or a safe deposit box at a bank are both solid choices. If you go with a bank box, just make sure you’ve legally authorized your executor or trustee to access it. The most important step? Tell your people where the documents are! Make sure your executor, trustee, and agents for your powers of attorney know the location of the originals and give them copies for their own records. This way, they can step in and help without delay when they're needed.

Navigating the world of wills, trusts, and powers of attorney can feel overwhelming, but you don’t have to figure it all out on your own. For professional document preparation and secure, convenient notarization services in Las Vegas, Signature on Demand is here to help. We ensure your estate planning documents are accurate and legally sound. Visit us at https://signatureondemand.net to see how we can assist you.

_edited.jpg)